When looking at leasing systems I am often reminded of the old adage when a tourist asks an Irishman for directions to Dublin and the response is ‘Well if I was going to Dublin I wouldn’t be starting from here!’.

The Circularity of Leasing Terminations

Leasing is a very circular business with the starting point for a new lease often being the end of an existing lease. This continuation can take multiple forms – Rollover, Release or Evergreen.

Rollover is where the old equipment is replaced with new equipment just before the end of the existing lease with the present value of any remaining rental payments being rolled over into the capital value for the new lease.

Release is where an extension is signed to the existing lease and the equipment remains in-situ.

The third option, Evergreen, is where the existing lease continues but the customer can return the equipment at any time with no penalty.

Of course, there are other factors to consider such as whether the termination is performed before the end of the contract, an early termination, or at the end of the contract, an end of term termination.

Which Termination approach is best for the Lessor?

All three lease continuation options have advantages to the lessor. From the capital goods manufacturer’s perspective, Rollover ensures the latest equipment is being used by their customers and their factories are kept busy. It also ensures the service side of the business doesn’t try to keep machines running that have been flogged to death.

A Release is generally very profitable as the capital cost of the machine is usually recovered in the lease prime period and any release rental, although reduced, is pure profit after any residual value from the prime period has been recovered. Evergreen is generally even more profitable as the original rent continues to be collected. It does however mean there is no contract in place and the customer therefore becomes more vulnerable to competitor attack.

Are there other factors to consider?

To get back to my opening statement, there are many starting points for a new lease where the termination values of an existing lease form part of the price of the new lease. Further complications arise if the sales system is separate to the finance and lease management system, with the termination values in the latter needing to be passed to the former and then the new lease values passed back.

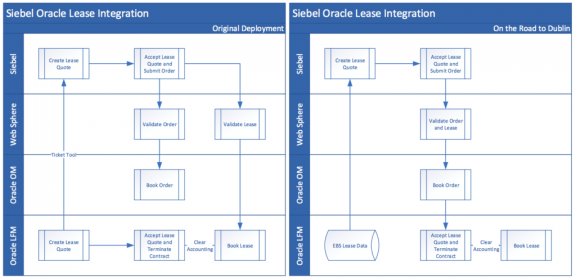

A European wide project I worked on for a large multi-national, involving a Siebel sales system integrated with an Oracle E-Business back-office, further complicated things as the Siebel project delivery lagged the EBS project significantly in the early stages. The result was the initial rollout involved passing the termination quote data from Oracle to Siebel manually with the request to accept the termination quote also being handled manually. The termination acceptance financial and operational data from EBS would then meet the new order/lease data passed from Siebel with the hope that it all matched up. Thankfully it did most of the time, but when you are processing large volumes of data even a small percentage of mismatches results in a large number of failures needing resolution.

Improving the Termination process

When the final European country went live, the Claremont team were given a chance to review the client’s termination processes to suggest improvements – allowing us to set off to Dublin starting from the right place!

Key to the change was the generation of the termination quote values in the Siebel front-office using data from the EBS back-office. Only once the new order was complete and submitted from Siebel to EBS was the contract termination quote created and accepted, terminating the contract. Not only did this save the client a lot of man hours by negating the need to prepare multiple termination quotes in EBS, but it also ensured the timing and values remained the same, so all the accounting reconciled – something that’s important in any financial system!

So why adopt OLFM to manage Terminations?

One of the strengths of Oracle Lease and Finance Management (OLFM) is its powerful Accounting engine. This comprises stream generation for numerous streams including the Rent and Interest Income, the accounting template sets of debit/credit pairs associated with each transaction type and the formulas that can be used to drive when a debit/credit pair are used and the value of the transaction.

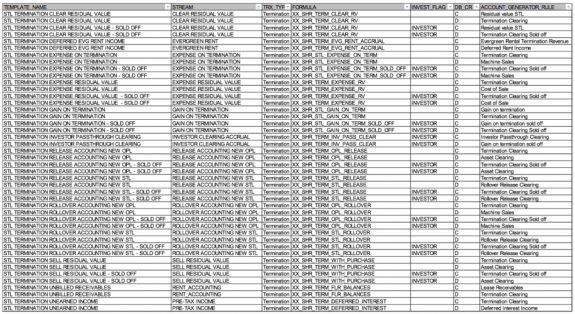

One of the biggest challenges in lease accounting is the many alternative termination types that need to be accommodated. For example, when the asset is being rolled over, it needs to use one set of debit/credit pairs and when it is being released it needs to use another set. On a lease termination the OLFM accounting engine will process all debit/credit pair templates for the termination transaction type and the formulas provide a very powerful tool to determine which debit/credit pairs have non-zero values and which have zero values.

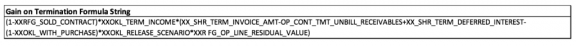

These embedded OLFM formulas consist of a set of sql functions linked by arithmetic functions into a string. The use of Boolean functions such as ‘Is_Release’ which returns a 1 if the termination reason is Release and 0 if not allow you to create a formula string such as (Is_Release)*(Termination_Value). This delivers a positive accounting transaction for that debit/credit pair if the termination reason is Release and a zero value transaction if not. As you can imagine, the termination accounting template sets and associated formula strings can become very extended as more termination factors are catered for.

Other factors to take into account

So, we have already looked at termination reasons having a bearing on Termination values, but there are still other factors to consider.

Key factors include:

- Whether the new contract has the same classification, Operating or Finance, as the old contract?

- Whether the old contract rentals were sold off to a third-party investor?

- Whether the lease is in prime period or evergreen?

- Whether the asset has any residual value and if so what type?

- Whether the contract is billing in advance or arrears?

As a result, a typical termination template set used to drive the values and accounting in OLFM could look as follows:

Some further thoughts

When I worked back on my first OLFM implementation in 2004 we hadn’t thought of surfacing these Boolean functions in the formula strings. As a result, we ended up developing very complex nested if statements in the formula functions. The downside of this was that when testing delivered the wrong value we had no idea where the calculation had failed.

However, because the application provides a formula test screen that details the values generated by each of the formula functions it becomes very easy to see which function has an issue and to get it corrected.

Summary

In summary, lease termination and its associated accounting can be very complex, and the accounting rules and standards associated with lease accounting continue to evolve and change. We do however feel that with the sophistication of the OLFM application and the extensive knowledge the Claremont team have gained in implementing OLFM over the past 15 years, we are in a strong position to handle whatever lease termination values and associated accounting the accountants can dream up. Dublin may not seem so far away after all!

If you would like further information about Oracle Lease and Finance Management and to talk to the Claremont delivery team contact us here.